6

Detection Theory

Let’s continue from Chapter 3, where you are the data scientist building the loan approval model for the (fictional) peer-to-peer lender ThriveGuild. As then, you are in the first stage of the machine learning lifecycle, working with the problem owner to specify the goals and indicators of the system. You have already clarified that safety is important, and that it is composed of two parts: basic performance (minimizing aleatoric uncertainty) and reliability (minimizing epistemic uncertainty). Now you want to go into greater depth in the problem specification for the first part: basic performance. (Reliability comes in Part 4 of the book.)

What are the different quantitative metrics you could use in translating the problem-specific goals (e.g. expected profit for the peer-to-peer lender) to machine learning quantities? Once you’ve reached the modeling stage of the lifecycle, how would you know you have a good model? Do you have any special considerations when producing a model for risk assessment rather than simply offering an approve/deny output?

Machine learning models are decision functions: based on the borrower’s features, they decide a response that may lead to an autonomous approval/denial action or be used to support the decision making of the loan officer. The use of decision functions is known as statistical discrimination because we are distinguishing or differentiating one class label from the other. You should contrast the use of the term ‘discrimination’ here with unwanted discrimination that leads to systematic advantages to certain groups in the context of algorithmic fairness in Chapter 10. Discrimination here is simply telling the difference between things. Your favorite wine snob talking about their discriminative palate is a distinct concept from racial discrimination.

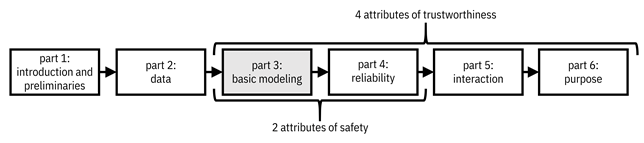

This chapter begins Part 3 of the book on basic modeling (see Figure 6.1 to remind yourself of the lay of the land) and uses detection theory, the study of optimal decision making in the case of categorical output responses,[1] to answer the questions above that you are struggling with.

Figure 6.1. Organization of the book. This third part focuses on the first attribute of trustworthiness, competence and credibility, which maps to machine learning models that are well-performing and accurate. Accessible caption. A flow diagram from left to right with six boxes: part 1: introduction and preliminaries; part 2: data; part 3: basic modeling; part 4: reliability; part 5: interaction; part 6: purpose. Part 3 is highlighted. Parts 3–4 are labeled as attributes of safety. Parts 3–6 are labeled as attributes of trustworthiness.

Specifically, this chapter focuses on:

§ selecting metrics to quantify the basic performance of your decision function (including ones that summarize performance across operating conditions),

§ testing whether your decision function is as good as it could ever be, and

§ differentiating performance in risk assessment problems from performance in binary decision problems.

6.1 Selecting Decision Function Metrics

You,

the ThriveGuild data scientist, are faced with the binary

detection problem, also known as the binary hypothesis testing problem, of predicting which

loan applicants will default, and thereby which applications to deny.[2]

Let ![]() be the loan

approval decision with label

be the loan

approval decision with label ![]() corresponding to

corresponding to ![]() and label

and label ![]() corresponding to

corresponding to ![]() . Feature vector

. Feature vector ![]() contains

employment status, income, and other attributes. The value

contains

employment status, income, and other attributes. The value ![]() is called a negative and the value

is called a negative and the value ![]() is called a positive. The random variables for the features and label

are governed by the pmfs given the special name likelihood

functions

is called a positive. The random variables for the features and label

are governed by the pmfs given the special name likelihood

functions ![]() and

and ![]() , as well as by prior probabilities

, as well as by prior probabilities ![]() and

and ![]() . The basic task is

to find a decision function

. The basic task is

to find a decision function ![]() that predicts a

label from the features.[3]

that predicts a

label from the features.[3]

6.1.1 Quantifying the Possible Events

There are four possible events in the binary detection problem:

1.

the

decision function predicts ![]() and the true label

is

and the true label

is ![]() ,

,

2.

the

decision function predicts ![]() and the true label

is

and the true label

is ![]() ,

,

3.

the

decision function predicts ![]() and the true label

is

and the true label

is ![]() , and

, and

4.

the

decision function predicts ![]() and the true label

is

and the true label

is ![]() .

.

These are known as true negatives (TN), false negatives (FN), true positives (TP), and false positives (FP), respectively. A true negative is denying an applicant who should be denied according to some ground truth, a false negative is denying an applicant who should be approved, a true positive is approving an applicant who should be approved, and a false positive is approving an applicant who should be denied. Let’s organize these events in a table known as the confusion matrix:

|

|

|

|

|

|

|

|

|

|

|

|

Equation 6.1

The probabilities of these events are:

|

|

|

|

|

|

Equation 6.2

These

conditional probabilities are nothing more than a direct implementation of the

definitions of the events. The probability ![]() is known as the true negative rate as well as the specificity and the

selectivity. The probability

is known as the true negative rate as well as the specificity and the

selectivity. The probability ![]() is known as the false negative rate as well as the probability of missed

detection and the miss rate. The probability

is known as the false negative rate as well as the probability of missed

detection and the miss rate. The probability ![]() is known as the true positive rate as well as the probability of

detection, the recall, the sensitivity, and the power. The probability

is known as the true positive rate as well as the probability of

detection, the recall, the sensitivity, and the power. The probability ![]() is known as the false positive rate as well as the probability of false

alarm and the fall-out. The probabilities can be organized in a slightly

different table as well:

is known as the false positive rate as well as the probability of false

alarm and the fall-out. The probabilities can be organized in a slightly

different table as well:

|

|

|

|

|

|

|

|

|

|

|

|

Equation 6.3

These

probabilities give you some quantities by which to understand the performance

of the decision function ![]() . Selecting one

over the other involves thinking about the events themselves and how they

relate to the real-world problem. A false positive, approving an applicant who

should be denied, means that a ThriveGuild lender has to bear the cost of a

default, so it should be kept small. A false negative, denying an applicant who

should be approved, is a lost opportunity for ThriveGuild to make a profit through

the interest they charge.

. Selecting one

over the other involves thinking about the events themselves and how they

relate to the real-world problem. A false positive, approving an applicant who

should be denied, means that a ThriveGuild lender has to bear the cost of a

default, so it should be kept small. A false negative, denying an applicant who

should be approved, is a lost opportunity for ThriveGuild to make a profit through

the interest they charge.

The events above are conditioned on the true label. Conditioning on the predicted label also yields events and probabilities of interest in characterizing performance:

|

|

|

|

|

|

|

|

|

|

|

|

Equation 6.4

These

conditional probabilities are reversed from Equation 6.2. The probability ![]() is known as the negative predictive value. The probability

is known as the negative predictive value. The probability ![]() is known as the false omission rate. The probability

is known as the false omission rate. The probability ![]() is known as the positive predictive value as well as the precision. The

probability

is known as the positive predictive value as well as the precision. The

probability ![]() is known as the false discovery rate. If you care about the quality of the

decision function, focus on the first set (

is known as the false discovery rate. If you care about the quality of the

decision function, focus on the first set (![]() ,

, ![]() ,

, ![]() ,

, ![]() ). If you care

about the quality of the predictions, focus on the second set (

). If you care

about the quality of the predictions, focus on the second set (![]() ,

, ![]() ,

, ![]() ,

, ![]() ).

).

When

you need to numerically compute these probabilities, apply the decision

function to several i.i.d. samples of ![]() and denote the

number of TN, FN, TP, and FP events as

and denote the

number of TN, FN, TP, and FP events as ![]() ,

, ![]() ,

, ![]() , and

, and ![]() , respectively. Then

use the following estimates of the probabilities:

, respectively. Then

use the following estimates of the probabilities:

|

|

|

|

|

|

|

|

|

|

|

|

Equation 6.5

As

an example, let’s say that ThriveGuild makes the following number of decisions:

![]() ,

, ![]() ,

, ![]() , and

, and ![]() . You can estimate

the various performance probabilities by plugging these numbers into the

respective expressions above. The results are

. You can estimate

the various performance probabilities by plugging these numbers into the

respective expressions above. The results are ![]() ,

, ![]() ,

, ![]() ,

, ![]() ,

, ![]() ,

, ![]() ,

, ![]() , and

, and ![]() . These are all

reasonably good values, but must ultimately be judged according to the ThriveGuild

problem owner's goals and objectives.

. These are all

reasonably good values, but must ultimately be judged according to the ThriveGuild

problem owner's goals and objectives.

6.1.2 Summary Performance Metrics

Collectively, false negatives and false positives are errors. The probability of error, also known as the error rate, is the sum of the false negative rate and false positive rate weighted by the prior probabilities:

![]()

Equation 6.6

The balanced probability of error, also known as the balanced error rate, is the unweighted average of the false negative rate and false positive rate:

![]()

Equation 6.7

They

summarize the basic performance of the decision function. Balancing is useful

when there are a lot more data points with one label than the other, and you

care about each type of error equally. Accuracy, the

complement of the probability of error: ![]() , and balanced accuracy, the complement of the balanced probability

of error:

, and balanced accuracy, the complement of the balanced probability

of error: ![]() , are sometimes

easier for problem owners to appreciate than error rates.

, are sometimes

easier for problem owners to appreciate than error rates.

The

![]() -score, the

harmonic mean of

-score, the

harmonic mean of ![]() and

and ![]() , is an

accuracy-like summary measure to characterize the quality of a prediction

rather than the decision function:

, is an

accuracy-like summary measure to characterize the quality of a prediction

rather than the decision function:

![]()

Equation 6.8

Continuing

the example from before with ![]() and

and ![]() , let ThriveGuild’s

prior probability of receiving applications to be denied according to some

ground truth be

, let ThriveGuild’s

prior probability of receiving applications to be denied according to some

ground truth be ![]() and applications

to be approved be

and applications

to be approved be ![]() . Then, plugging in

to the relevant equations above, you’ll find ThriveGuild to have

. Then, plugging in

to the relevant equations above, you’ll find ThriveGuild to have ![]() ,

, ![]() , and

, and ![]() . Again, these are

reasonable values that may be deemed acceptable to the problem owner.

. Again, these are

reasonable values that may be deemed acceptable to the problem owner.

As

the data scientist, you can get pretty far with these abstract TN, FN, TP, and

FP events, but they have to be put in the context of the problem owner’s goals.

ThriveGuild cares about making good bets on borrowers so that they are

profitable. More generally across real-world applications, error events yield

significant consequences to affected people including loss of life, loss of

liberty, loss of livelihood, etc. Therefore, to truly characterize the

performance of a decision function, it is important to consider the costs associated with the different events. You can

capture these costs through a cost function ![]() and denote the

costs as

and denote the

costs as ![]() ,

, ![]() ,

, ![]() , and

, and ![]() , respectively.

, respectively.

Taking

costs into account, the characterization of performance for the decision

function is known as the Bayes risk ![]() :

:

![]()

Equation 6.9

Breaking

the equation down, you’ll see that the two error probabilities, ![]() and

and ![]() are the main

components, multiplied by their relevant prior probabilities and costs. The

costs of the non-error events appear just multiplied by their costs. The Bayes

risk is the performance metric most often used in finding optimal decision

functions. Actually finding the decision function is known as solving the Bayesian detection problem. Eliciting the cost function

are the main

components, multiplied by their relevant prior probabilities and costs. The

costs of the non-error events appear just multiplied by their costs. The Bayes

risk is the performance metric most often used in finding optimal decision

functions. Actually finding the decision function is known as solving the Bayesian detection problem. Eliciting the cost function ![]() for a given

real-world problem from the problem owner is part of value alignment, described

in Chapter 14.

for a given

real-world problem from the problem owner is part of value alignment, described

in Chapter 14.

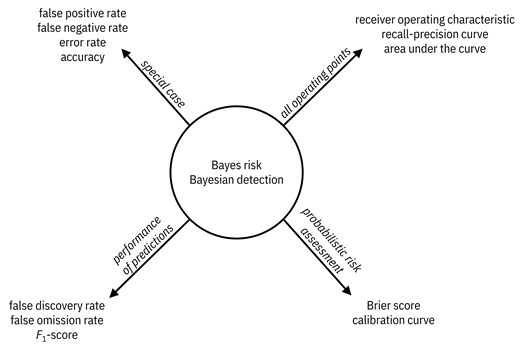

A mental model or roadmap, shown in Figure 6.2, to hold throughout the rest of the chapter is that the Bayes risk and the Bayesian detection problem are the central concept, and all other concepts are related to the central concept in various ways and for various purposes. The terms and concepts that have not yet been defined and evaluated are coming up soon.

Figure 6.2. A mental model for different concepts in

detection theory surrounding the central concept of Bayes risk and Bayesian

detection. A diagram with Bayes risk and Bayesian detection at the center

and four other groups of concepts radiating outwards. False positive rate,

false negative rate, error rate, and accuracy are special cases. Receiver

operating characteristic, recall-precision curve, and area under the curve

arise when examining all operating points. Brier score and calibration curve

arise in probabilistic risk assessment. False discover rate, false omission

rate, and ![]() -score relate to

performance of predictions.

-score relate to

performance of predictions.

Because

getting things right is a good thing, it is often assumed that there is no cost

to correct decisions, i.e., ![]() and

and ![]() , which is also

assumed in this book going forward. In this case, the Bayes risk simplifies to:

, which is also

assumed in this book going forward. In this case, the Bayes risk simplifies to:

![]()

Equation 6.10

To

arrive at this simplified equation, just insert zeros for ![]() and

and ![]() in Equation 6.9. The

Bayes risk with

in Equation 6.9. The

Bayes risk with ![]() and

and ![]() is the probability

of error.

is the probability

of error.

We

are implicitly assuming that ![]() does not depend on

does not depend on

![]() except through

except through ![]() . This assumption

is not required, but made for simplicity. You can easily imagine scenarios in

which the cost of a decision depends on the feature. For example, if one of the

features used in the loan approval decision by ThriveGuild is the value of the

loan, the cost of an error (monetary loss) depends on that feature.

Nevertheless, for simplicity, we usually make the assumption that the cost

function does not explicitly depend on the feature value. For example, under

this assumption, the cost of a false negative may be

. This assumption

is not required, but made for simplicity. You can easily imagine scenarios in

which the cost of a decision depends on the feature. For example, if one of the

features used in the loan approval decision by ThriveGuild is the value of the

loan, the cost of an error (monetary loss) depends on that feature.

Nevertheless, for simplicity, we usually make the assumption that the cost

function does not explicitly depend on the feature value. For example, under

this assumption, the cost of a false negative may be ![]() and the cost of a

false positive

and the cost of a

false positive ![]() for all applicants.

for all applicants.

6.1.3 Accounting for Different Operating Points

The

Bayes risk is all well and good if there is a fixed set of prior probabilities

and a fixed set of costs, but things change. If the economy improves, potential

borrowers might become more reliable in loan repayment. If a different problem

owner comes in and has a different interpretation of opportunity cost, then the

cost of false negatives ![]() changes. How

should you think about the performance of decision functions across different

sets of those values, known as different operating points?

changes. How

should you think about the performance of decision functions across different

sets of those values, known as different operating points?

Many

decision functions are parameterized by a threshold ![]() (including the

optimal decision function that will be demonstrated in Section 6.2). You can

change the decision function to be more or less forgiving of false positives or

false negatives, but not both at the same time. Varying

(including the

optimal decision function that will be demonstrated in Section 6.2). You can

change the decision function to be more or less forgiving of false positives or

false negatives, but not both at the same time. Varying ![]() explores this

tradeoff and yields different error probability pairs

explores this

tradeoff and yields different error probability pairs ![]() , i.e. different

operating points. Equivalently, different operating points correspond to

different false positive rate and true positive rate pairs

, i.e. different

operating points. Equivalently, different operating points correspond to

different false positive rate and true positive rate pairs ![]() . The curve traced

out on the

. The curve traced

out on the ![]() –

–![]() plane as the parameter

plane as the parameter

![]() is varied from

zero to infinity is the receiver operating characteristic

(ROC). The ROC takes values

is varied from

zero to infinity is the receiver operating characteristic

(ROC). The ROC takes values ![]() when

when ![]() and

and ![]() when

when ![]() . You can

understand this because at one extreme, the decision function always says

. You can

understand this because at one extreme, the decision function always says ![]() ; in this case

there are no FPs and no TPs. At the other extreme, the decision function always

says

; in this case

there are no FPs and no TPs. At the other extreme, the decision function always

says ![]() ; in this case all

decisions are either FPs or TPs.

; in this case all

decisions are either FPs or TPs.

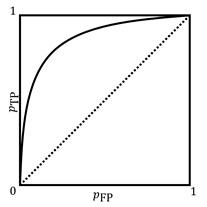

The

ROC is a concave, nondecreasing function illustrated in Figure 6.3. The closer

to the top left corner it goes, the better. The best ROC for discrimination

goes straight up to ![]() and then makes a

sharp turn to the right. The worst ROC is the diagonal line connecting

and then makes a

sharp turn to the right. The worst ROC is the diagonal line connecting ![]() and

and ![]() achieved by random

guessing. The area under the ROC, also known as the area

under the curve (AUC) synthesizes performance across all operating

points and should be selected as a metric when it is likely that the same

threshold-parameterized decision function will be applied in very different

operating conditions. Given the shapes of the worst (diagonal line) and best

(straight up and then straight to the right) ROC curves, you can see that the

AUC ranges from

achieved by random

guessing. The area under the ROC, also known as the area

under the curve (AUC) synthesizes performance across all operating

points and should be selected as a metric when it is likely that the same

threshold-parameterized decision function will be applied in very different

operating conditions. Given the shapes of the worst (diagonal line) and best

(straight up and then straight to the right) ROC curves, you can see that the

AUC ranges from ![]() (area of bottom

right triangle) to

(area of bottom

right triangle) to ![]() (area of entire

square).[4]

(area of entire

square).[4]

Figure 6.3. An example receiver operating characteristic

(ROC). Accessible caption. A plot with ![]() on the vertical

axis and

on the vertical

axis and ![]() on the horizontal

axis. Both axes range from

on the horizontal

axis. Both axes range from ![]() to

to ![]() . A dashed diagonal

line goes from

. A dashed diagonal

line goes from ![]() to

to ![]() and corresponds to

random guessing. A solid concave curve, the ROC, goes from

and corresponds to

random guessing. A solid concave curve, the ROC, goes from ![]() to

to ![]() staying above and

to the left of the diagonal line.

staying above and

to the left of the diagonal line.

6.2 The Best That You Can Ever Do

As the ThriveGuild data scientist, you have given the problem owner an entire menu of basic performance measures to select from and indicated when different choices are more and less appropriate. The Bayes risk is the most encompassing and most often used performance characterization for a decision function. Let’s say that Bayes risk was chosen in the problem specification stage of the machine learning lifecycle, including selecting the costs. Now you are in the modeling stage and need to figure out if the model is performing well. The best way to do that is to optimize the Bayes risk to obtain the best possible decision function with the smallest Bayes risk and compare the current model’s Bayes risk to it.

“The predictability ceiling is often ignored in mainstream ML research. Every prediction problem has an upper bound for prediction—the Bayes-optimal performance. If you don't have a good sense of what it is for your problem, you are in the dark.”

—Mert R. Sabuncu, computer scientist at Cornell University

Let

us denote the best possible decision function as ![]() and its

corresponding Bayes risk as

and its

corresponding Bayes risk as ![]() . They are

specified using the minimization of the expected cost:

. They are

specified using the minimization of the expected cost:

![]()

Equation 6.11

where

the expectation is over both ![]() and

and ![]() . Because it

achieves the minimal cost, the function

. Because it

achieves the minimal cost, the function ![]() is the best

possible

is the best

possible ![]() by definition.

Whatever Bayes risk

by definition.

Whatever Bayes risk ![]() it has, no other

decision function can have a lower Bayes risk

it has, no other

decision function can have a lower Bayes risk ![]() .

.

We aren’t going to work it out here, but the solution to the minimization problem in Equation 6.11 is the Bayes optimal decision function, and takes the following form:

![]()

Equation 6.12

where

![]() , known as the likelihood ratio, is defined as:

, known as the likelihood ratio, is defined as:

![]()

Equation 6.13

and

![]() , known as the threshold, is defined as:

, known as the threshold, is defined as:

![]()

Equation 6.14

The

likelihood ratio is as its name says: it is the ratio of the likelihood

functions. It is a scalar value even if the features ![]() are multivariate. As

the ratio of two non-negative pdf values, it has the range

are multivariate. As

the ratio of two non-negative pdf values, it has the range ![]() and can be viewed

as a random variable. The threshold is made up of both costs and prior

probabilities. This optimal decision function

and can be viewed

as a random variable. The threshold is made up of both costs and prior

probabilities. This optimal decision function ![]() given in Equation 6.12

is known as the likelihood ratio test.

given in Equation 6.12

is known as the likelihood ratio test.

6.2.1 Example

As

an example, let ThriveGuild’s loan approval decision be determined solely by

one feature ![]() : the income of the

applicant. Recall that we modeled income to be exponentially-distributed in Chapter

3. Specifically, let

: the income of the

applicant. Recall that we modeled income to be exponentially-distributed in Chapter

3. Specifically, let ![]() and

and ![]() , both for

, both for ![]() . Like earlier in

this chapter,

. Like earlier in

this chapter, ![]() ,

, ![]() ,

, ![]() , and

, and ![]() . Then simply

plugging in to Equation 6.13, you’ll get:

. Then simply

plugging in to Equation 6.13, you’ll get:

![]()

Equation 6.15

and plugging in to Equation 6.14, you’ll get:

![]()

Equation 6.16

Plugging these expressions into the Bayes optimal decision function given in Equation 6.12, you’ll get:

![]()

Equation 6.17

which can be simplified to:

![]()

Equation 6.18

by

multiplying both sides of the inequalities in both cases by ![]() , taking the

natural logarithm, and then multiplying by

, taking the

natural logarithm, and then multiplying by ![]() again. Applicants

with an income less than or equal to

again. Applicants

with an income less than or equal to ![]() are denied and

applicants with an income greater than

are denied and

applicants with an income greater than ![]() are approved. The

expected value of

are approved. The

expected value of ![]() is

is ![]() and the expected

value of

and the expected

value of ![]() is

is ![]() . Thus in this

example, an applicant's income has to be quite a bit higher than the mean to be

approved.

. Thus in this

example, an applicant's income has to be quite a bit higher than the mean to be

approved.

You

should use the Bayes-optimal risk ![]() to lower bound the

performance of any machine learning classifier that you might try for a given

data distribution.[5]

No matter how hard you work or how creative you are, you can never overcome the

Bayes limit. So you should be happy if you get close. If the Bayes-optimal risk

itself is too high, then the thing to do is to go back to the data understanding

and data preparation stages of the machine learning lifecycle and get more

informative data.

to lower bound the

performance of any machine learning classifier that you might try for a given

data distribution.[5]

No matter how hard you work or how creative you are, you can never overcome the

Bayes limit. So you should be happy if you get close. If the Bayes-optimal risk

itself is too high, then the thing to do is to go back to the data understanding

and data preparation stages of the machine learning lifecycle and get more

informative data.

6.3 Risk Assessment and Calibration

To approve or to deny, that is the question for ThriveGuild. Or is it? Maybe the question is actually: what is the probability that the borrower will default? Maybe the problem is not binary classification, but probabilistic risk assessment. It is certainly an option for you, the data scientist, and the problem owner to consider during problem specification. Thresholding a probabilistic risk assessment yields a classification, but there are a few subtleties for you to weigh.

The

likelihood ratio ranges from zero to infinity and the threshold value ![]() is optimal for

equal priors and equal costs. Applying any monotonically increasing function to

both the likelihood ratio and the threshold still yields a Bayes optimal

decision function with the same risk

is optimal for

equal priors and equal costs. Applying any monotonically increasing function to

both the likelihood ratio and the threshold still yields a Bayes optimal

decision function with the same risk ![]() . That is,

. That is,

![]()

Equation 6.19

for

any monotonically increasing function ![]() is still optimal.

is still optimal.

It

is somewhat more natural to think of a score ![]() to be in the range

to be in the range

![]() because it

corresponds to the label values

because it

corresponds to the label values ![]() and could also

potentially be interpreted as a probability. The score, a continuous-valued

output of the decision function, can then be thought of as a confidence in the

prediction and be obtained by applying a suitable

and could also

potentially be interpreted as a probability. The score, a continuous-valued

output of the decision function, can then be thought of as a confidence in the

prediction and be obtained by applying a suitable ![]() function to the

likelihood ratio. In this case,

function to the

likelihood ratio. In this case, ![]() is the threshold

for equal priors and costs. Intermediate score values are less confident and

extreme score values (towards

is the threshold

for equal priors and costs. Intermediate score values are less confident and

extreme score values (towards ![]() and

and ![]() ) are more

confident. Just as the likelihood ratio may be viewed as a random variable, the

score may also be viewed as a random variable

) are more

confident. Just as the likelihood ratio may be viewed as a random variable, the

score may also be viewed as a random variable ![]() . The Brier score is an appropriate performance metric for the

continuous-valued output score of the decision function:

. The Brier score is an appropriate performance metric for the

continuous-valued output score of the decision function:

![]()

Equation 6.20

It

is the mean-squared error of the score ![]() with respect to

the true label

with respect to

the true label ![]() . For a finite

number of samples

. For a finite

number of samples ![]() , you can compute

it as:

, you can compute

it as:

Equation 6.21

The

Brier score decomposes into the sum of two separable components: calibration and refinement.[6]

The concept of calibration is that the predicted score corresponds to the

proportion of positive true labels. For example, a bunch of data points all

having a calibrated score of ![]() implies that 70%

of them have true label

implies that 70%

of them have true label ![]() and 30% of them

have true label

and 30% of them

have true label ![]() . Said another way,

perfect calibration implies that the probability of the true label

. Said another way,

perfect calibration implies that the probability of the true label ![]() being

being ![]() given the

predicted score

given the

predicted score ![]() being

being ![]() is the value

is the value ![]() itself:

itself: ![]() Calibration is

important for probabilistic risk assessments: a perfectly calibrated score can

be interpreted as a probability of predicting one class or the other. It is

also an important concept for evaluating causal inference methods, described in

Chapter 8, for algorithmic fairness, described in Chapter 10, and for

communicating uncertainty, described in Chapter 13.

Calibration is

important for probabilistic risk assessments: a perfectly calibrated score can

be interpreted as a probability of predicting one class or the other. It is

also an important concept for evaluating causal inference methods, described in

Chapter 8, for algorithmic fairness, described in Chapter 10, and for

communicating uncertainty, described in Chapter 13.

Since

any monotonically increasing transformation ![]() can be applied to

a decision function without changing its ability to discriminate, you can

improve the calibration of a decision function by finding a better

can be applied to

a decision function without changing its ability to discriminate, you can

improve the calibration of a decision function by finding a better ![]() . The calibration

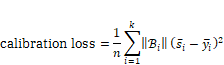

loss quantitatively captures how close a decision function is to perfect calibration.

The refinement loss is a sort of variance of how tightly the true labels

distribute around a given score. For

. The calibration

loss quantitatively captures how close a decision function is to perfect calibration.

The refinement loss is a sort of variance of how tightly the true labels

distribute around a given score. For ![]() that have been

sorted by their score values and binned into

that have been

sorted by their score values and binned into ![]() groups

groups ![]() with average

values

with average

values ![]() within the bins

within the bins

Equation 6.22

As stated earlier, the sum of the calibration loss and refinement loss is the Brier score.

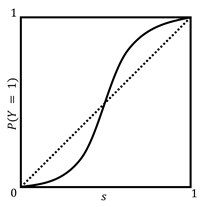

A

calibration curve, also known as a reliability

diagram, shows the ![]() values as a plot.

One example is shown in Figure 6.4. The closer to a straight diagonal from

values as a plot.

One example is shown in Figure 6.4. The closer to a straight diagonal from ![]() to

to ![]() , the better.

Plotting this curve is a good diagnostic tool for you to understand the

calibration of a decision function.

, the better.

Plotting this curve is a good diagnostic tool for you to understand the

calibration of a decision function.

Figure 6.4. An example calibration curve. Accessible

caption. A plot with![]() on the vertical

axis and

on the vertical

axis and ![]() on the horizontal

axis. Both axes range from

on the horizontal

axis. Both axes range from ![]() to

to ![]() . A dashed diagonal

line goes from

. A dashed diagonal

line goes from ![]() to

to ![]() and corresponds to

perfect calibration. A solid S-shaped curve, the calibration curve, goes from

and corresponds to

perfect calibration. A solid S-shaped curve, the calibration curve, goes from ![]() to

to ![]() starting below and

to the right of the diagonal line before crossing over to being above and to

the left of the diagonal line.

starting below and

to the right of the diagonal line before crossing over to being above and to

the left of the diagonal line.

6.4 Summary

§ Four possible events result from binary decisions: false negatives, true negatives, false positives, and true positives.

§ Different ways to combine the probabilities of these events lead to classifier performance metrics appropriate for different real-world contexts.

§ One important one is Bayes risk: the combination of the false negative probability and false positive probability weighted by both the costs of those errors and the prior probabilities of the labels. It is the basic basic performance measure for the first attribute of safety and trustworthiness.

§ Detection theory, the study of optimal decisions, which provides fundamental limits to how well machine learning models may ever perform is a tool for you to assess the basic performance of your models.

§ Decision functions may output continuous-valued scores rather than only hard, zero or one, decisions. Scores indicate confidence in a prediction. Calibrated scores are those for which the score value is the probability of a sample belonging to a label class.